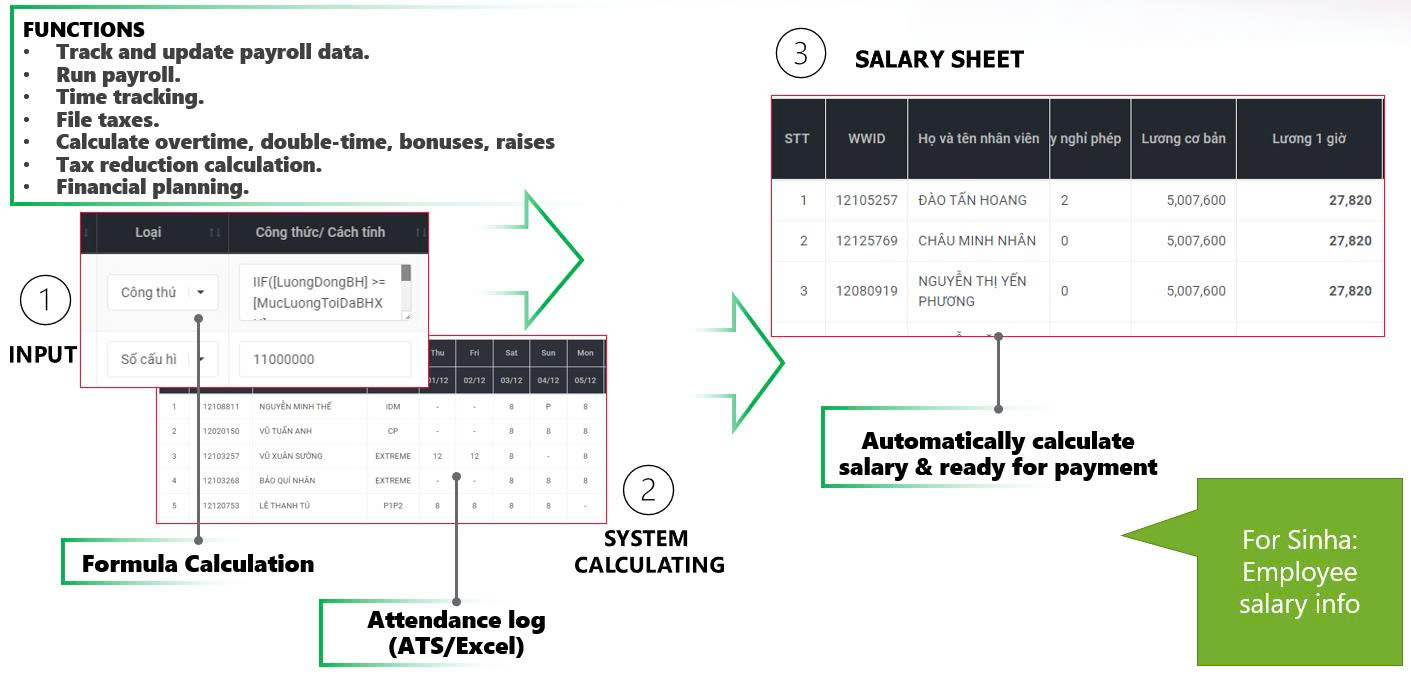

Attendance data and payroll formulas are entered into the system, which then runs payroll automatically according to the defined rules. HR can focus on reviewing results instead of re-entering figures and recalculating salaries multiple times in spreadsheets.

Payroll System

Green Speed’s payroll system is designed to help HR teams, HR managers and company leaders monitor, update and run payroll in a consistent way, reducing manual work and lowering the risk of errors. The entire process — from attendance data and payroll formulas to the final payroll sheet — is processed on a single, centralised platform.

Key advantages of Green Speed’s payroll system

Store and adjust base salary, allowances, deductions and bonuses by employee and by payroll period.

Apply predefined payroll formulas to input data and generate consolidated payroll by month or by pay cycle.

Use working hours, shifts and working days as the basis for salary calculation, linked to attendance logs from the system or Excel files.

Apply rules for overtime, multipliers, bonuses and salary changes that have been defined in the payroll formulas.

How the payroll system works

|

Data input

|

|

|

Processing and output

|

What problems does Green Speed’s payroll system help solve?

Attendance logs from the system or data files are used as inputs to calculate working hours, overtime and working days. Using a single source of data makes it easier to reconcile working time with the salary paid and helps reduce discrepancies.

Once payroll has been run, the system can summarise payroll figures by pay period, department or employee group. These summaries give companies a clearer basis for reviewing labour costs and planning HR budgets for upcoming periods.

Rules for overtime, multipliers, bonuses and salary changes are embedded in the payroll formulas. At each pay cycle, the system applies these rules consistently across employees, helping avoid omissions and ensuring a uniform calculation method.

From the consolidated payroll, the system can provide figures needed for income, deductions and related obligations, making it easier for the responsible team to prepare information for tax filings and internal payroll tax documentation.